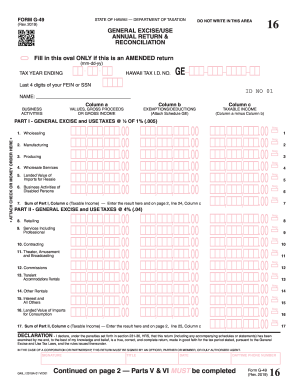

Get the free hawaii tax form g 45 fillable

Get, Create, Make and Sign

Editing hawaii tax form g 45 fillable online

How to fill out hawaii tax form g

Who needs Hawaii tax form G?

Video instructions and help with filling out and completing hawaii tax form g 45 fillable

Instructions and Help about form g 45 fillable

Hello ladies and gentlemen my name is Raymond, and today we're going to go over how to file a general excise g45 tax return for the state of Hawaii, and today we're going to be using actual revenue first as the last video I did which was a zero return very simple this one not so much but still not too hard either so let's go ahead and get to the Excel file here where we can pool our revenue and deductions for one deduction I should say so here we have the revenue for Oahu Maui and Hawaii this month Kauai didn't generate any revenue, so first I'm going to go over how to file for one County, and then we're going to jump into it and start filing the actual return which is for all three counties for the sake of this example today I'm going to use my GE number for my company and my company's name anytime you have a sublease deduction you're going to need this information for the other entity or entities involved okay to get started we'll go back to the sign-in page here and get right into it as you can see here we have the G 45 and the G 49 g49 is the annual we won't have to do that until just before April 20th with holding HW 14 and HW 3 these are both payroll functions we won't be going into those either today so let's jump into G 45 here as you see here there's the red triangle that means it's ready to file yeah we'll click Next on this screen and as I said before we will start with just one district the district of Oahu we know there's going to be an exemption, so we'll go yes here next we didn't have any wholesaling activities for any of our business this month, so we're not going to enter anything into these fields but if you do have whole selling items this is where it'll go, so this is only charged 05 rate versus the 4 or 425 to 45 depending on which island you're doing business with all right so here we go the income we have today is all rental income so the example I'm going to use here for Oahu we're going to use this top line here which is before the deduction as you can see here this is the total after the deduction, so we're going to get that three hundred and sixty-nine thousand and change, and we're going to put it in this field, and then we're going to put the deduction here now when I click out of this sale you're going to see this number here change and what you're going to see it do is you're going to see a subtract just like the 295 542 that we see in this cell the calculation this is important to note if you're going to do multiple islands it will not calculate the same way, and I'm going to show you so let's go ahead and hit previous after I click on these two it will delete the information I've already entered so click Next Soho selling activity as mentioned earlier here you will see the three islands are now blank for Maui and the Island of Hawaii it'll be pretty straightforward let's go ahead get that information and just because it is simple now for Oahu as I mentioned there is a difference so when we go back to excel here...

Fill g45 form no download needed : Try Risk Free

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your hawaii tax form g online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.